If you follow our blog, then you are definitely familiar with trader Larry Levin, President of Trading Advantage LLC. We have gotten such a great response from some of his past posts that he has agreed to share one more of his favorite trading tips as a special treat to our viewers. Determining the direction of the market can be tricky and just plain confusing at times, but Larry’s expert opinion keeps it simple and straight-to-the-point.

If you like this article, Larry’s also agreed to give you free access to his weekly trading tip.

Today he’s going to talk about how the open of the market can make or break your trading day.

The open for any trading session can set the tone for the day’s trade. Barring any major fundamentals, it can signal whether or not traders are going to be primarily bearish or bullish, or neutral and cautious. The start of the day can set the stage for your own trades as well. Starting off with a winning trade or having the market move in your favor at the beginning of the day gives you a confidence level that can propel you to an extremely successful trading day. Having a negative tone or having the market move against your analysis and any open positions will probably color your judgment for the rest of the day.

It all starts with your first trade of the day, and I actually have a method I use to try to get on the right side of the market minutes after the open.

I think the open can actually be one of the best times of day to trade.

Markets often open in one of three ways:

Balanced - if the market opens in balance, many traders will stand aside looking for opportunities later in the trading session. This is the type of open many successful traders tend to stay away from. This open causes nothing but trouble for the average trader who tends to chase trends that may never materialize.

Out of Balance to the Upside - if the market opens out of balance to the upside, traders will look for a way to buy the market as soon as possible. This is the type of day where I believe excellent trading opportunities can likely be found.

Out of Balance to the Downside - if the market opens out of balance to the downside, traders will look for a way to sell the market as soon as possible. This is the other type of day where I believe excellent trading opportunities can likely be found.

Experienced traders will watch for these signals to determine possible entry or exit opportunities.

Long opportunities will present themselves if the market opens and trends higher throughout the day. If that opening tick is the lowest price for the session, traders will look to jump on board with long positions. The same concept applies for bearish positions on a day where the opening tick is the highest price for the session. Be wary of a trend that forms after the market traded on either side of that opening tick – the pattern would be potentially weaker.

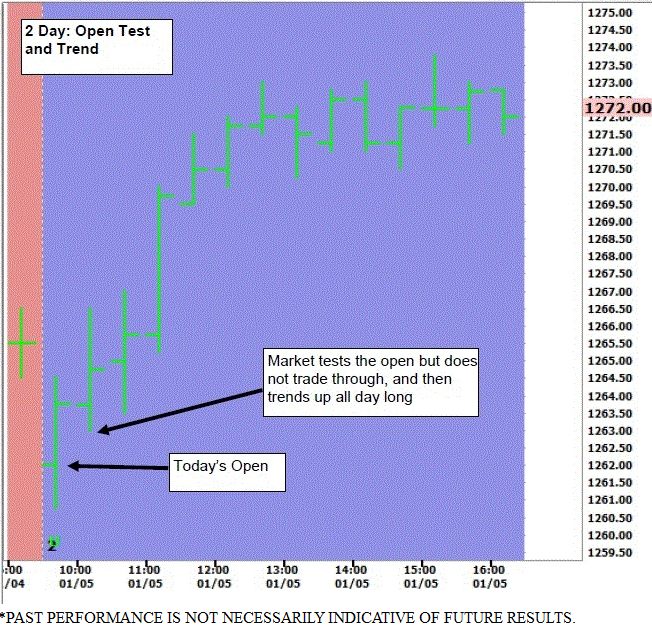

The exception to this would be a market that is testing support or resistance after the open. If the market opens, trades to a known technical resistance or support level, and then turns and doesn’t try to go there again, it could still be a trending day.

A day that fails to provide a strong indication for a trend following the opening can be telling you something about the market sentiment that day. Traders may be confused or lacking in conviction. This can be heralded by low volume on the open and a lot of back and forth.

On days without a trend many traders avoid trying to call a breakout or skip trading altogether.

Using the Value Area rule, it is possible to find opportunities here and there in markets, but try to not call breakouts unless you see clear signals. A market that is in “balance” opens inside the Value Area. It will likely not have a big trending day unless something knocks it “out of balance.” Markets that open outside the Value Area or out of “balance” could see big days, but watch how they move after that opening tick. You should be able to tell within the first few bars whether or not it is likely to be a poor trading environment with limited opportunities.

Click Here to gain access to Larry's weekly trading tip.

Larry Levin

President & Founder- Trading Advantage

larry@tradingadvantage.com

Disclaimer: Futures and options trading involves a substantial degree of risk and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Secrets of Traders LLC provides only training and educational information. By accessing any Secrets of Traders or Trading Advantage content, you agree to be bound by the terms of service. Click Here to review the terms of service.

No comments:

Post a Comment