If you follow our blog, then you are definitely familiar with trader Larry Levin, President of Trading Advantage LLC. We have gotten such a great response from some of his past posts that he has agreed to share one more of his favorite trading tips as a special treat to our viewers. Determining the direction of the market can be tricky and just plain confusing at times, but Larry’s expert opinion keeps it simple. If you like this article, Larry’s also agreed to give you free access to his Double Stop trading technique.

On a candlestick chart, there is a pattern that technicians refer to as a doji. A doji has top and bottom shadows like a regular candlestick, but has practically no real body. This happens when the opening and closing price are the same, or so close that they just leave a sliver of a real body. A doji looks like a plus sign or cross.

Finding a Doji can tell a technical analyst key things about a market trend

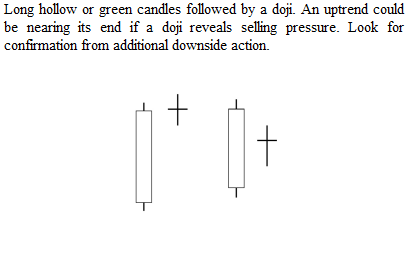

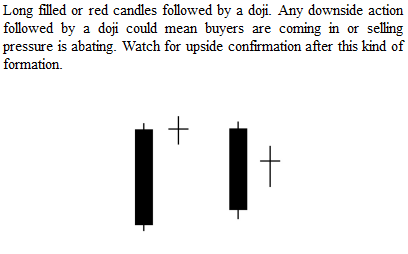

Doji are considered a good sign of indecision in a market. Finding a doji with short and nearly identical shadow points suggests a neutral trading session. The market opened, had a small trading range, and then closed at the opening price. Neither bulls nor bears got the upper hand. Longer shadows show potentially greater indecision. They are neutral on their own, but paired with a trend, a doji can hint at a coming change.

Market participants looking for a reversal like to see Doji

Doji are like little battle scars of conflict. The trade had action but in the end no one won the day and the market closed pretty much where it started. If the market was on a bullish trend, this could be a signal that the bears were coming in. The opposite could be deduced if the market was in a bearish trend.

A technician's reversal argument is simple. If the dominant trend were still in control, there wouldn't have been a wrestling match for control. And there would have been a clear winner. Instead, the real body showed that the day was almost a wash.

Simple doji to look out for:

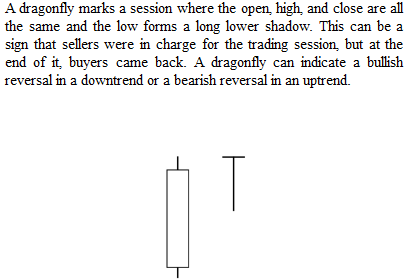

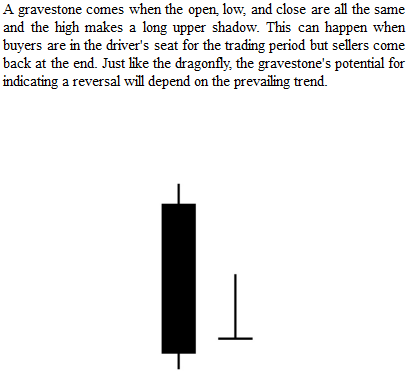

There are also a few special doji to watch for. Some form patterns with fantastic names like abandoned baby, morning star, evening star, and tri-star. Two worth mentioning are the dragonfly doji and gravestone doji. These are unique in that the real body is at the top or bottom of a long shadow.

Both patterns need to be seen as part of a bigger picture. Look for confirmation after they occur.

Doji are common candlestick patterns - look for them in your favorite market and watch what happens around them

Doji are candlestick patterns that can show a significant wrestling match is in the works. Neither the bull nor the bear are dominating the trading period. This means that you have to look at the whole chart - not just a single candlestick - to confirm the potential in a doji. What you are looking for is something that will tip the scales, a sign that someone will take the advantage. I look at doji as yellow flags during any trend. Tread carefully until the bigger picture is revealed.

Click here to see Larry’s Double Stop trading technique.

Best Trades to you,

Larry Levin

Founder & President- Trading Advantage

Disclaimer: Trading in futures and options involves a substantial degree of a risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results.

No comments:

Post a Comment