Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Wednesday, the 11th of December.

Hello traders everywhere! Adam Hewison here, President of INO.com and co-creator of MarketClub, with your video update for Wednesday, the 11th of December.

Stocks To Watch Today

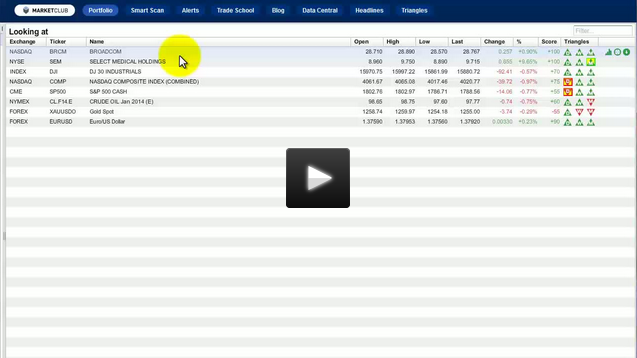

There are two stocks on my radar today that showed up with new recent Trade Triangles, Broadcom (NASDAQ:BRCM) and Select Medical Holdings (NYSE:SEM). You may want to take a look at these stocks as they show good upside potential. I will be reporting on them later next week. In the meantime, let us know what you think of these stocks and how high you think they can go.

Equities - Bullish

Generally speaking, the major indices (DOW 30, S&P 500, NASDAQ) continue to be in bullish trends, as the major long-term Trade Triangles and intermediate-term Trade Triangles are positive. Pretty soon we could be hearing talk about a "Santa Claus rally" and I expect stocks to continue to trend higher for the balance of the year.

Energy - Bullish

The rally I discussed in the energy complex a few weeks ago is underway and appears ready to move higher. Technically speaking, the markets can still go further, perhaps to the $100 level basis crude oil. Look for the ETF USO (PACF:USO) to continue to benefit and trend higher.

Gold - Trading Range

With a Chart Analysis Score of -55, the gold market continues to be wrapped in a wide trading range. One of the best tools to use in trading range markets is an oscillator like the RSI. There is support that comes in for spot gold around the $1,200 an ounce level and heavy resistance at the $1,400 level. I believe that if the $1,200 level holds, gold could be setting up for a significant rally in 2014. Gold traders are looking at tapering in Q1 of 2014 and the onset of inflationary forces pushing gold prices higher and potentially pushing the dollar down. That type of scenario would help contribute to higher gold prices. I am, as always, going to rely on the unbiased Trade Triangle technology that listens to the market and not what the talking heads are pushing out.

The Dollar - Bearish

The US Dollar continues to lose ground against the Euro and I expect this trend to continue in the near term. I am looking for the Euro to move up to the 1.40 level and perhaps higher before the end of the year. If this forecast changes, the Trade Triangles will keep us informed and we will move and trade accordingly.

We appreciate your feedback, questions and comments. Please feel free to comment and interact with us below.

Thanks, and every success in the market.

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Adam appears frequently on the following financial news channels as a guest expert. Click on any cable logo to watch Adam's latest appearance.

No comments:

Post a Comment